Analysis of 2016 Premium Changes and Insurer Participation in the Affordable Care Actfs Health Insurance Marketplaces

Jun 24, 2015 - The Henry J. Kaiser Family Foundation

Cynthia Cox, Rosa Ma, Gary Claxton, and Larry Levitt

Introduction

An updated analysis of 2016 premiums in Affordable Care Act marketplaces is available here.

________________________________________________________________

Premium growth in the Affordable Care Actfs Health Insurance Marketplaces has been an area of significant interest, as this is one of the most tangible and measurable indicators of whether the ACA is working to keep health insurance affordable. The ACAfs rate review provision requires premium increases over ten percent to be made public. As a number of individual market insurers are requesting 2016 increases well above 10 percent, concern has been raised over the affordability of premiums in the coming year. However, these increases are not necessarily representative of the range of products from which consumers will be able to choose, and similar data is not widely available for the plans with moderate increases or decreases.

This brief presents an early analysis of changes in the premiums for the lowest- and second-lowest cost silver marketplace plans in major cities in 10 states plus the District of Columbia, where we were able to find complete data on rates for all insurers. It follows a similar approach to our September 2013 and 2014 analyses of Marketplace premiums.

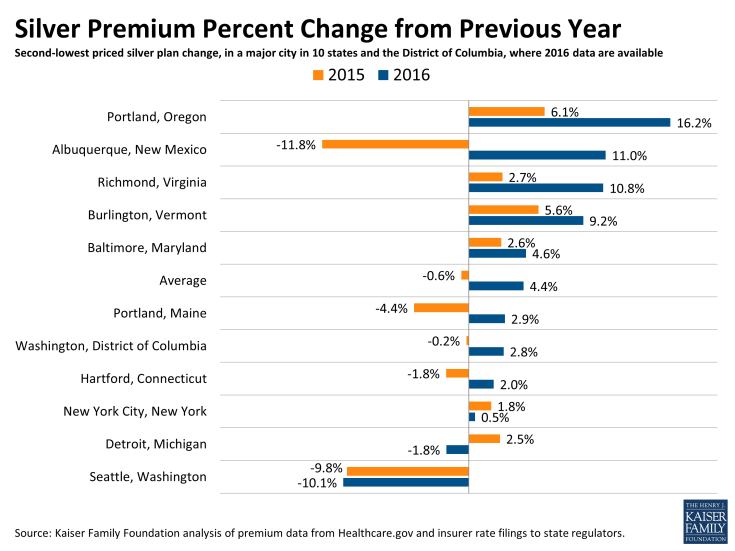

In most of these 11 major cities, we find that the costs for the lowest and second-lowest cost silver plans – where the bulk of enrollees tend to migrate – are changing relatively modestly in 2016, although increases are generally bigger than in 2015. The cost of a benchmark silver plan in these cities is on average 4.4% higher in 2016 than in 2015. These premiums are still preliminary in some cases and could be raised or lowered through these statesf rate review processes, and it is difficult to generalize to all states based on this small sample of states where all rate filings are available. We also find that the number of insurers participating has stayed the same or increased in 9 states, while insurer participation decreased in Michigan and the District of Columbia.

Approach

In preparation for open enrollment for coverage in 2016, insurers filed premiums with state insurance departments. States vary in whether and when they release those filings. Our analysis is based on the 10 states plus the District of Columbia where we were able to find comprehensive filings or other information about the rates of the lowest-cost plans. Other states have released summary information, but not sufficient detail to identify the lowest-cost silver plans. In many cases, premiums are still under review by insurance departments and may change prior to the start of open enrollment.

We examine premiums in the rating area that includes a major city in each state. Premiums vary significantly within states, with the rating area being the smallest geographic unit by which insurers are allowed to vary rates. For each rating area, we look at premiums for the two lowest-cost silver plans. We focus on silver plans because they are the basis for federal premium subsidies and because these are the plans that most marketplace enrollees (68%) have chosen.

Changes in Lowest Two Silver Plans

Across the 11 cities we examined, the premium for the second-lowest-cost silver plan in the Marketplace – before accounting for any tax credit – is increasing by an average of 4.4%. By contrast, in these cities, the average change in the benchmark silver plan was -0.6% from 2014 to 2015. (The nationwide average increase in this plan was 2% from 2014 to 2015).

| Table 1: Monthly Benchmark Silver Premiums for a 40 Year Old Non-Smoker Making $30,000 / Year | |||||||

| State | Rating Area (Major City) |

2nd Lowest Cost Silver Before Tax Credit | 2nd Lowest Cost Silver After Tax Credit | ||||

| 2015 | 2016 | % Change from 2015 | 2015 | 2016 | % Change from 2015 | ||

| Connecticut | 2 (Hartford) | $322 | $328 | 2.0% | $208 | $208 | 0.2% |

| DC | 1 (Washington) | $242 | $248 | 2.8% | $208 | $208 | 0.2% |

| Maine | 1 (Portland) | $282 | $290 | 2.9% | $208 | $208 | 0.2% |

| Maryland | 1 (Baltimore) | $235 | $246 | 4.6% | $208 | $208 | 0.2% |

| Michigan | 1 (Detroit) | $230 | $226 | -1.8% | $208 | $208 | 0.2% |

| New Mexico | 1 (Albuquerque) | $171 | $190 | 11.0% | $171* | $190* | 11.0%* |

| New York | 4 (New York City) | $372 | $374 | 0.5% | $208 | $208 | 0.2% |

| Oregon | 1 (Portland) | $213 | $248 | 16.2% | $208 | $208 | 0.2% |

| Vermont | 1 (Burlington) | $436 | $476 | 9.2% | $208 | $208 | 0.2% |

| Virginia | 7 (Richmond) | $260 | $288 | 10.8% | $208 | $208 | 0.2% |

| Washington | 1 (Seattle) | $254 | $228 | -10.1% | $208 | $208 | 0.2% |

| Average % change from 2015 | 4.4% | 1.2% | |||||

|

SOURCE: Kaiser Family Foundation analysis of 2016 insurer rate

filings to state regulators.

NOTES: Rates are not yet final and subject to review by the state.

Oregon rates reflect preliminary changes from the state. *Unsubsidized

Albuquerque premiums are so low that a 40 year old making $30,000 per year

would not qualify for a premium tax credit in 2016 | |||||||

| Table 2: Monthly Lowest-Cost Silver Premiums for a 40 Year Old Non-Smoker Making $30,000 / Year | |||||||

| State | Rating Area (Major City) |

Lowest Cost Silver Before Tax Credit | Lowest Cost Silver After Tax Credit | ||||

| 2015 | 2016 | % Change from 2015 | 2015 | 2016 | % Change from 2015 | ||

| Connecticut | 2 (Hartford) | $321 | $327 | 1.9% | $207 | $207 | 0.1% |

| DC | 1 (Washington) | $239 | $244 | 2.1% | $205 | $204 | -0.6% |

| Maine | 1 (Portland) | $275 | $284 | 3.4% | $201 | $202 | 0.7% |

| Maryland | 1 (Baltimore) | $226 | $232 | 2.6% | $199 | $194 | -2.2% |

| Michigan | 1 (Detroit) | $219 | $210 | -4.2% | $197 | $192 | -2.3% |

| New Mexico | 1 (Albuquerque) | $167 | $186 | 11.5% | $167* | $186* | 11.5%* |

| New York | 4 (New York City) | $372 | $369 | -0.7% | $207 | $203 | -1.9% |

| Oregon | 1 (Portland) | $212 | $228 | 7.7% | $207 | $189 | -8.6% |

| Vermont | 1 (Burlington) | $428 | $471 | 10.0% | $200 | $203 | 1.6% |

| Virginia | 7 (Richmond) | $241 | $287 | 19.0% | $189 | $208 | 9.8% |

| Washington | 1 (Seattle) | $235 | $225 | -4.2% | $189 | $205 | 8.6% |

| Average % change from 2015 | 4.5% | 1.5% | |||||

|

SOURCE: Kaiser Family Foundation analysis of 2016 insurer rate

filings to state regulators.

NOTES: Rates are not yet final and subject to review by the state.

Oregon rates reflect preliminary changes from the state. *Unsubsidized

Albuquerque premiums are so low that a 40 year old making $30,000 per year

would not qualify for a premium tax credit in 2016 | |||||||

| Table 3: Changes in Lowest-Cost Silver Products | |||

| State | Rating Area (Major City) |

Is the 2015 Lowest-Cost Silver Still One of Two Lowest Silvers in 2016? | Is the 2015 Second-Lowest-Cost Silver Still One of Two Lowest Silvers in 2016? |

| Connecticut | 2 (Hartford) | Yes | No |

| DC | 1 (Washington) | N/A* | N/A* |

| Maine | 1 (Portland) | Yes | Yes |

| Maryland | 1 (Baltimore) | Yes | No |

| Michigan | 1 (Detroit) | Yes | No |

| New Mexico | 1 (Albuquerque) | No | No |

| New York | 4 (New York City) | No | No |

| Oregon | 1 (Portland) | No | No |

| Vermont | 1 (Burlington) | Yes | No |

| Virginia | 7 (Richmond) | No | No |

| Washington | 1 (Seattle) | Yes | No |

|

SOURCE: Kaiser Family Foundation analysis of 2016 insurer rate

filings to state regulators

NOTES: Rates are not yet final and subject to review by the

state.*The District of Columbia did not public sufficient detail to

determine whether plans are the same as those offered in 2015, but the

insurers are the same. | |||

| Table 4: Changes in Insurers Offering the Lowest-Cost Silver Products | |||

| State | Rating Area (Major City) | Would person enrolled in 2015 Lowest-Cost Silver Have to Switch Insurers to Stay in One of Two Lowest Plans? | Would person enrolled in 2015 Second-Lowest-Cost Silver Have to Switch Insurers to Stay in One of Two Lowest Plans? |

| Connecticut | 2 (Hartford) | No | No |

| DC | 1 (Washington) | No | No |

| Maine | 1 (Portland) | No | No |

| Maryland | 1 (Baltimore) | No | Yes |

| Michigan | 1 (Detroit) | No | Yes |

| New Mexico | 1 (Albuquerque) | Yes | No |

| New York | 4 (New York City) | Yes | Yes |

| Oregon | 1 (Portland) | No | Yes |

| Vermont | 1 (Burlington) | No | No |

| Virginia | 7 (Richmond) | Yes | Yes |

| Washington | 1 (Seattle) | No | Yes |

|

SOURCE: Kaiser Family Foundation analysis of 2016 insurer rate

filings to state regulators

NOTES: Rates are not yet final and subject to review by the

state. | |||

| Table 5: Number of Insurers, Grouped by Parent Company, Participating in Marketplaces, 2014 – 2016 | |||

| State | 2014 | 2015 | 2016 |

| Connecticut | 3 | 4 | 4 |

| DC | 3 | 3 | 2 (Aetna exited) |

| Maine | 2 | 3 | 4 (Aetna entered) |

| Maryland | 4 | 5 | 5 |

| Michigan | 9 | 13 | 12 (Assurant exited) |

| New Mexico | 4 | 5 | 5 |

| New York | 16 | 16 | 16 |

| Oregon | 11 | 10 | 11 (Zoom Health entered) |

| Vermont | 2 | 2 | 2 |

| Virginia | 5 | 6 | 6 |

| Washington | 7 | 9 | 11 (UnitedHealth and Health Alliance entered) |

| AVERAGE | 6.0 | 6.9 | 7.1 |

|

SOURCE: Kaiser Family Foundation analysis of 2016 insurer rate

filings to state regulators

NOTES: Filings are not yet final and subject to review by the

state. | |||